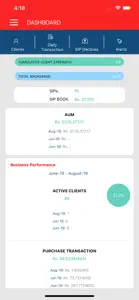

MIRR Investments

App for mutual funds

About MIRR Investments

- Released

- Updated

- iOS Version

- Age Rating

- Size

- Devices

- Languages

Features

Developer of MIRR Investments

What's New in MIRR Investments

2.1

August 2, 2023

Bug fixes and improvements

MIRR Investments FAQ

Does MIRR Investments have support for iPad devices?

Yes, MIRR Investments is compatible with iPad devices.

Who released the MIRR Investments app?

MIRR Investments was launched by Namrata B Durgan.

What is the lowest iOS version that MIRR Investments can run on?

MIRR Investments currently supports iOS 11.0 or later.

How does the app rank among users?

No ratings have been provided for the MIRR Investments app so far.

What’s the app category of MIRR Investments?

The Main Genre Of The Mirr Investments App Is Finance.

What is the recent version of the MIRR Investments app?

2.1 is the newly released MIRR Investments version.

What date was the latest MIRR Investments update?

MIRR Investments rolled out its latest update on December 2, 2024.

What was the MIRR Investments release date?

MIRR Investments originally came out on November 17, 2024.

What is the age rating for MIRR Investments?

MIRR Investments is suitable for children aged Namrata B Durgan.

What are the languages supported by MIRR Investments?

MIRR Investments is available in English.

Is MIRR Investments accessible through Apple Arcade's subscription model?

Unfortunately, MIRR Investments is not on Apple Arcade.

Does MIRR Investments allow for in-app purchases?

No, MIRR Investments does not allow for in-app purchases.

Can I use MIRR Investments with Apple Vision Pro?

No, you cannot use MIRR Investments with Apple Vision Pro.

Are there any advertisements in MIRR Investments?

No, there are no advertisements in MIRR Investments.