Pickright is a new-age finance app focused on making investing and trading accessible and seamless for our users. At Pickright we believe that financial freedom is not for a select few but should be attainable by everybody.Pickright has an array of features that will enable the next billion users of India to achieve Financial freedom.

Knowledge and advice on Finance are available at large. But while we sit for thorough research, the conflicting advice available on the market can confuse and leave our financial decisions hanging.

Hence Pickright is a platform where you can find reliable and trustworthy finance advice. We do this by providing you with a platform of SEBI-registered advisors & analysts for your investment and trading needs.

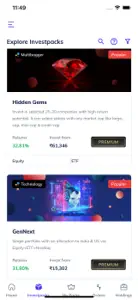

Investpack

Investing is easy but investing in such a way to beat market volatility is a tough task. This includes a ton of research, time & energy from your side. At Pickright, we have readymade, diversified portfolios created by SEBI-registered experts called Investpacks.

These diversified stock portfolios (Investpacks) are a good mix of, equities, ETFs, gold & bonds. There is a wide list of Investpacks that you can choose from according to your investment amount & risk appetite.

According to market performance, the SEBI registered experts will also send timely rebalance notifications, so you can stay insulated against market volatility.

How is Investpack better than Mutual Funds?

Transparency of all the assets involved, rebalancing and other crucial information is available when you purchase an Investpack, unlike Mutual Funds.

All the benefits of the stocks involved will be available to the Investpack owner.

The advisor does not manage your portfolio, just advises. In simple words, you directly own the shares of the company, not through a broker or agent, unlike Mutual Funds.

You manage your portfolio directly via a Demat account. You have complete ownership of your portfolio. The SEBI registered expert will however guide you through the process. Whether or not the advice should be executed is 100% in your hands.

Systematic Investment Planning (SIP) is the most crucial part of a mutual fund through which you can see the compounding of the money invested. However, when you invest in a diversified portfolio/ Investpack, it is created in such a way, as to give you maximum returns & growth even with a one-time investment.

Trading Advisory

Get trading ideas from SEBI-registered experts for massive financial growth.

From trading calls to options trading, currency, commodity and more. Boost your portfolio with NSE and BSE listings, & keep an eye on global market trends with comprehensive charts, including TradingView charts

FLEXIBLE INVESTMENT OPTIONS

Whether it is lump sum investments or starting an SIP, whether you are looking for Long-term investment or short-term plans - Pickright accommodates your unique investment journey.

SECURE AND REGISTERED

Your trust & security are our top priorities. Pickright is a registered platform, ensures that your investments are safeguarded by industry standards.

-We're fully compliant with SEBI regulations, offering you peace of mind when you trade in the markets, be it futures, options, or other instruments.

-Estimate the returns on your investment with our handy SIP Calculator & other trading indicator.

Seamless experience in Investing & Trading.

Pickright has partnered with leading brokers so you can invest and trade efficiently in one app. Some of Pickright’s brokers are Zerodha, 5 Paisa, Upstox, Bajaj Finserv, Clever Trade, Nuvama, Aditya Birla Money Limited, Trade Smart, Angel Broking, Paytm, Master Trust.

info@pickright.in

Disclaimer:

Investments in the securities market are subject to market risks, read all the related documents carefully before investing. This is for education purposes only & should not be considered as advice, consult your financial advisor before investing.

Full Disclaimer: https://pickright.in/disclaimer

Show less