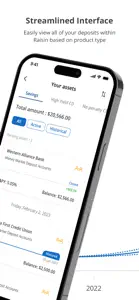

With a single secure Raisin login, you can fund savings products across our exclusive nationwide network of federally insured banks and credit unions. It only takes a few minutes to open a free account and verify your identity, allowing you to access savings products from any of our partner financial institutions without needing to enter sensitive personal information multiple times. We are more than a rate comparison tool — we're a single platform that allows you to manage all of your short- and long-term savings iin one intiutive dashboard and secure your savings.

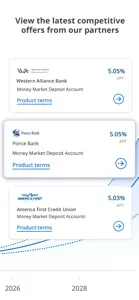

Our unique savings platform is a single marketplace where you can access top rates on federally insured savings products from trusted banks and credit unions — all for free. Banks and credit unions choose to partner with Raisin to offer our customers their best digital-only products and rates. While shopping for rates and opening accounts at multiple institutions requires ample time and effort, with Raisin all it takes is one free sign-up in order to access any of the institutions in our platform.

Why choose Raisin?

• Federally insured savings products: Because Raisin only partners with FDIC insured banks and NCUA insured credit unions, you can rest assured that your money remains secure up to the typical limits of up to $250,000 per depositor, per institution. Because these limits are per institution, you can use the Raisin platform to get more of your money covered by federal deposit insurance without needing to juggle multiple passwords. From your single Raisin account, you can easily allocate your funds across a variety of institutions, letting you take advantage to secure your funds up to per-institution limits at each insured institution within our network.

• Security: Cybersecurity is a top priority for Raisin which is why we invest in a variety of technologies to keep our customers' data, privacy, and transactions secure, including Multi-Factor authentication, encryption, and Cloudflare advanced internet protection and monitoring. We are a SOC 2 certified organization, which means we have met the requirements outlined by the American Institute of Certified Public Accountants (AICPA) to ensure that we have the controls in place to keep customers' data secure and private.

• No fees: Raisin does not charge our customers any fees — seriously. That means there are no fees to open an account, no fees to deposit money, and no fees to withdraw funds from high-yield savings or money market deposit accounts. The only fee you may encounter is an early withdrawal penalty on a fixed-term CD, as outlined in that product's terms. Plus, our products all have a $1 minimum initial deposit, making it simple to start earning interest.

• Choice: Savings products from our partners offer flexible terms and some of the most competitive rates on the market. Use our platform to design a customized savings strategy that allows you to lock in top rates for longer terms while retaining liquidity on funds you may need sooner.

• Convenience: No matter the number of products you have or the number of institutions with which you have funds deposited, all of your savings within the Raisin platform are managed wtihin a single, streamlined dashboard and appear together in a single digital monthly account statement.

How to open an account

1) Select the right product to kickstart your savings journey from any of our federally insured partner financial institutions.

2) Register for your free account — it takes less than five minutes.

3) Fund your new savings product and start earning interest. And add additional products at any time to take advantage of our ever-growing catalog of products.

You're invited to begin your savings journey. Open a Raisin account in minutes and start saving today.

Privacy Policy: https://assets-us.raisin.com/en-us/privacy_policy.pdf

Show less